- NJASA

- Financial Corner Sept. 23

-

How Are You Protecting Your Pension?

I am honored to follow in the footsteps of the legend, Mort Reinhart, as NJASA’s new Pension and Retirement Consultant. Mort was a wealth of knowledge. I could not be more grateful to NJASA for giving me the opportunity to continue to provide the same level of expertise that Mort did for its membership. I feel privileged to join this amazing team of professionals and look forward to meeting and working with all of you.

Set time to complete your annual pension checkup.

Since 2012, the Division of Pensions and Benefits stopped printing and mailing your pension statement to you. This information has been available online under the Personal Benefit Statement tab on the Members Benefits Online System (MBOS). Therefore, every year I recommend that you log in and review your statement, just like you did when you received your paper copy.

Confirm your account information. Check your:

- Total Pension Service Credit;

- Total Employee Contributions and;

- Group Life Insurance Benefits.

To determine if you should be protecting your pension, you will need your Personal Benefit information. Therefore, print/save your information and share it with your beneficiary(s).

Do you have 25 years of service?

If you were to pass away without a retirement application on file, only your pension contributions and the life insurance benefits would go to your beneficiary. Once you have 25 years or more in your Total Pension Service Credit, your benefit changes. You should generate a retirement estimate and determine if protecting your pension for your spouse and/or family would be beneficial.

You can accomplish this by going to the Retirement tab.

- After you run an estimate of your retirement benefits, look at the option labeled Option 1.

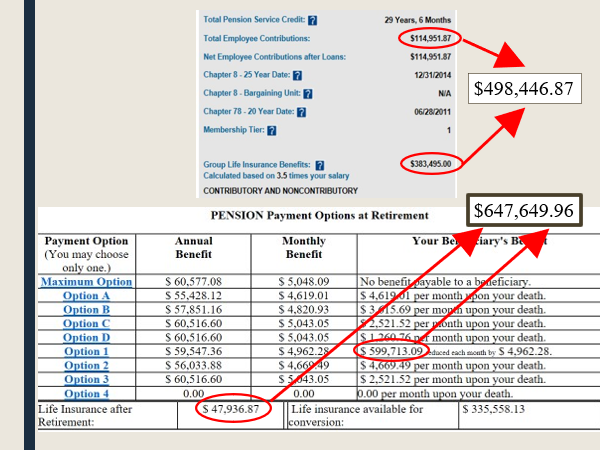

- Take the Lump Sum Amount and add the Life Insurance After Retirement amount to it, which is listed on the bottom left.

- Compare this total amount to the sum of your Total Employee Contributions and the Group Life Insurance Benefit on your Personal Benefit Statement that you printed/saved.

If the estimate is greater, you should consider filing a retirement application annually to protect your pension. While there are other factors to consider, this is the first step. Then, if you unexpectedly pass away while still working, your family may receive either a larger payout or your spouse may receive a lifetime of income.Below is an example showing the Personal Benefit Statement at the top and the Retirement Estimate in the chart. If this employee had a retirement application on file with the Division of Pensions and Benefits at the time of their passing, the spouse would receive a significant increase in the lump sum benefit. Since there are other factors to consider and there are specific rules regarding this, I encourage you to schedule a meeting to review your personal situation and determine which option would be best for you.